Wealth Management

7 Habits to Help You Build Wealth

The American Dream has long centered on upward mobility, the idea that anyone can work hard to become successful and prosperous regardless of their origin. For...

Mortgage

What Is Home Equity?

Owning a home means more than just having a place to keep your things. It’s where memories, comfort, and your financial future all come together. If you’ve ev...

Wealth Management

21 Questions to Ask a Wealth Manager

A good financial relationship begins with open conversation; after all, choosing a wealth manager isn’t only about investment performance. It’s about finding ...

Mortgage

The Pros and Cons of Buying a Foreclosed Home

Buying a home is one of the biggest financial decisions you’ll ever make. For some buyers in Northwest Missouri and Arkansas, exploring foreclosed properties ...

Mortgage

.jpg)

Buying a Second Home in a College Town

College towns have always held a unique appeal when it comes to real estate, for both families and investors. Whether you’re a parent preparing to send your c...

Mortgage

%20(11).jpg)

What is Title Theft

Your home is one of the biggest financial investments you’ll make in your lifetime, so it’s important to protect it. Identity theft is on the rise, with nearly...

Savings

%20(16).jpg)

Creating Your Savings Plan

Are you looking for a fresh start for your savings plan in the new year? As the calendar turns over, it’s a great time to review your annual savings goals and ...

Mortgage

%20(10).jpg)

Making Your Home More Energy Efficient

We enjoy a lovely climate here in Northwest Arkansas and Southwest Missouri. Our summers are sunny but not too hot, and our winters are mild but not too cold....

Mortgage

%20(5).jpg)

How Does the Mortgage Application Process Work

Buying your first home is an exciting milestone, but navigating the process can be confusing for a first-time buyer. The mortgage application process especiall...

Savings

%20(2).jpg)

5 Benefits of a Christmas Club Account

Although holiday spending is expected to drop by 5% this year, the big question is how much of that spending will take the form of debt. Every year, Americans...

Savings

%20(4).jpg)

How to Earn More Interest on Your Savings

As wages continue to grow in the U.S., many people who may have put off saving in the past are beginning to think about how they can start setting aside funds ...

Mortgage

%20(3).jpg)

The Cost of Buying a Home vs. Renting in Northwest Arkansas and Southwest Missouri

One of the most common questions we receive here at CS Bank is whether or not buying a home during high inflation a good idea. With home prices and interest r...

Mortgage

%20(15).jpg)

How To Pay Off Your Mortgage Faster

Home mortgages are usually considered “good debt” with low interest rates. However, that doesn’t mean you shouldn’t pay off your mortgage sooner than scheduled...

Mortgage

%20(40).jpg)

Cassville First Time Homebuyer Do’s and Don'ts

So you’re ready to start on the journey of purchasing your first home, but are maybe feeling a little apprehensive about the whole undertaking. Maybe you’ve re...

Mortgage

%20(17).jpg)

Why You Should Work With A Full-Service Mortgage Division

When it comes to getting a mortgage to buy a home, your first decision is choosing a mortgage lender. From online-only lenders to brick-and-mortar banks and cr...

Mortgage

%20(47).jpg)

Guide to Choosing a Mortgage

The homebuying process can be confusing and with so many moving pieces, it’s hard to keep track. Not only are you searching for the right home, but you’re also...

Mortgage

%20(53).jpg)

What is a HELOC and How Does it Work?

With today’s high interest, finding financing with lower interest rates is more important than ever—potentially saving you hundreds or thousands of dollars ov...

Mortgage

%20(41).jpg)

What is a Rural Development Loan and How Do I Get One?

USDA Loans are popular mortgage choices in rural areas like Southwest Missouri and Northwest Arkansas. They provide affordable home loan options with no down ...

Mortgage

%20(18).jpg)

Should You Buy a Home During Inflation?

During inflation, the cost of buying a home can increase substantially. This makes it harder for first-time homebuyers to find affordable housing solutions an...

Mortgage

%20(48).jpg)

When To Consider A Variable Rate Mortgage

When it comes to choosing a mortgage loan, you have a variety of options. Whether you go with a conventional mortgage or a government-insured loan such as an F...

Mortgage

%20(44).jpg)

8 Expenses for New Homeowners to Prepare for

As you are preparing to purchase your first home, you already know that you’ll need to save a lot of money upfront for your down payment and closing costs. But...

Mortgage

%20(56).jpg)

First-Time Home Buyers Guide For Northwest Arkansas

Are you ready to buy your first home in Holiday Island, Huntsville, Harrison, Eureka Springs or Berryville, Arkansas? It’s a happy milestone and our area is a...

Mortgage

%20(42).jpg)

What Do I Need To Apply For A Mortgage In Northwest Arkansas?

Buying your first home is a big and exciting milestone. It can also feel overwhelming, but CS Home Mortgage is here to help. In this ultimate guide, we’ll wal...

Mortgage

%20(55).jpg)

Do I have to Put Down 20% to Buy a Home in Northwest Arkansas?

With home prices still at record highs, many potential homebuyers—whether first time buyers or buyers with low or moderate incomes—may find it difficult to com...

Mortgage

%20(57).jpg)

Should I Choose a Short Term or Long Term Fixed Mortgage Loan?

When it comes to applying for a home mortgage loan, there are many choices and decisions to make. For example, what type of loan can you qualify for? Should yo...

Mortgage

%20(26).jpg)

How to Prepare for your First Winter in Your New Home

When you are a new homeowner, the tasks and expenses associated with taking care of your home can seem overwhelming. From routine maintenance and everyday mino...

Mortgage

%20(39).jpg)

FHA VS. Conventional Mortgage Loans: Which One's Right for You?

The process of buying a home — from setting a budget and applying for a loan to putting an offer on the right property—is an intimidating process for anyone. ...

General

%20(23).jpg)

How to Start an Emergency Fund

It’s happened to everyone: out of the blue, an unexpected cost arises, threatening to ruin your day (or your month!) and your budget. Whether it’s a surprise c...

Loans

%20(14).jpg)

Guide to Buying a Car from a Private Seller

In the past few decades, car buying options have evolved dramatically with the introduction of online car-selling platforms. A major component of online car p...

Loans

%20(28).jpg)

What Can A Personal Loan Be Used For?

While U.S. Economic Confidence has increased since it hit rock bottom in April 2020, it still hasn’t rebounded to pre-pandemic levels. With many people still ...

General

%20(32).jpg)

Get Your Finances in Order With This Annual Checkup

Has your life changed in the past year? Whether you switched jobs, got married or divorced, had a baby, bought a house … or even if your life hasn’t changed o...

Mortgage

%20(43).jpg)

Construction Loans: Building Your House from the Ground Up

Have you always dreamed of building a brand-new home, designed just the way you want and need? Or perhaps new construction is appealing in the context of hist...

Mortgage

%20(35).jpg)

Getting Your House In Order: How To Pay For Renovations

Whether you’re hoping to stay in your current home for a few more years or you’re getting ready to put it on the market, working on renovations is a great way...

Loans

%20(54).jpg)

Guide to Jumbo Loans in Northwest Arkansas and Southwest Missouri

If you’re looking to upgrade your home this year and the cost of your new property is too high for a conventional mortgage loan, consider taking out a jumbo l...

Savings

%20(19).jpg)

Do I Need a Savings Account for my Business

For most Americans, a balanced banking relationship contains a combination of checking and savings accounts. Just as it makes sense for your personal finances...

Fraud

%20(31).jpg)

What is a Romance Scam?

Love is in the air at this time of the year, but that also means a rise in fraudsters looking to capitalize on your good nature and trick you into a romance sc...

Fraud

%20(36).jpg)

Protecting Your Small Business from Scams

Small businesses lose around 5% of their revenue every year as a result of fraud and scams. Cybersecurity issues, fraud and online scams are some of the bigge...

General

Community Bank Vs. Fintechs: How Do They Stack Up?

In a rapidly evolving financial landscape, community banks continue to stand out as pillars of stability, offering a comprehensive lineup of services that merg...

General

8 Smart Strategies for Responsible Credit Card Use

There is a certain thrill that comes with getting your first credit card. With a credit card, there’s no need to worry about the exact amount of money in your ...

Fraud

%20(46).jpg)

How to Safely Use PayPal and Avoid Scams

The number of cybersecurity threats seems to rise every year and payment app scams are no exception. If you use PayPal, you know it can be a convenient and se...

General

How to Make a Budget: Stop Overspending and Reach Your Financial Goals

With the New Year upon us, now is a great time to take a hard look at our spending habits and make plans for how to achieve our financial goals. Creating and r...

Uncategorized

%20(29).jpg)

Benefits of Mobile Wallets for Personal and Business Use

With continuous technological advancements and widespread acceptance by businesses and consumers, mobile (digital) wallets have become a fundamental tool for...

Fraud

%20(34).jpg)

5 Ways to Prevent Bank Fraud

The FBI’s Internet Crime Complaint Center received a record number of complaints in 2020, for a total of 791,790 complaints of suspected Internet crime totalin...

Uncategorized

%20(50).jpg)

How Autobooks and QuickBooks Compare for Small Businesses

Whether it's building the next tech empire or simply making a good living, small business owners share one thing in common: they're passionate and determined t...

Fraud

%20(13).jpg)

8 Online Holiday Shopping Safety Tips

The holiday shopping season is upon us and online shopping is becoming increasingly popular each year. Online holiday shopping increased almost 45% from 2019 t...

General

How To Lower Debt This Year

With the average American having around $58,604 of debt and nearly 80% of households nationally having some form of debt, tackling your own may feel like an o...

Fraud

8 Ways To Keep Your Data Safe Online

Keeping ahead of cybercriminals and protecting your data systems is crucial for any individual or business. As technology advances, so do the methods that hac...

Fraud

%20(25).jpg)

How to Recognize and Avoid Zelle Scams

If you already use the payment app Zelle, you probably love the convenience of instantly sending and receiving money between your checking account and anyone ...

Digital Services

%20(38).jpg)

What is Autobooks and How Can it Help Your Business?

Starting a small business can be a daunting undertaking, with so many details beyond simply creating the best product, service, or experience for your customer...

Fraud

What is Elder Financial Fraud and How to Prevent it

With a record number of US citizens turning 65 this year often referred to as the ‘silver tsunami’—elder financial fraud will certainly be a continued area of ...

Fraud

%20(27).jpg)

8 Debit Card Security Tips To Keep You Safe

Debit cards are a convenient part of our everyday lives. Whether you’re grabbing coffee from your favorite coffee shop, withdrawing cash from your checking acc...

Checking

%20(12).jpg)

Smart Holiday Shopping Tips

Another holiday shopping season is upon us, but this year, inflation may present a snag in your plans. Now more than ever, it’s important to shop smart for th...

Mortgage

How to Buy a New House When You're Selling Your Own

Real estate is a very local business, but in recent years buyers and sellers across the country have faced the same challenges. When interest rates dropped to ...

Mortgage

When to Refinance a Mortgage

Mortgages are a long-term expense. Although they’re often seen as “good debt”, your financial situation may not look different compared to when you originally ...

Community

%20(30).jpg)

Eureka Springs Relocation Guide

Whether you’ve been visiting Eureka Springs for years or you’re planning your first trip into town, there’s nothing quite like this mountainside haven nestled ...

Mortgage

College Tuition Got You Stressed? Your Home Equity Could Be the Answer

The average cost of college in the United States for a four-year undergraduate degree program is $108,584 per student, including books, supplies, and daily li...

Checking

%20(37).jpg)

Choosing a Rewards Checking Account

There’s a seemingly endless number of personal checking accounts boasting interest rates that no other account can match. When the average account offers you ...

Mortgage

The Gen Z Guide to Saving for Your First Home

Buying a home is a big deal and can be a huge expense for any budget, but especially if you are first starting out. And trying to save for a home while rentin...

Agriculture

%20(51).jpg)

Guide to Starting a Farm in Berryville

Starting a Farm in Berryville Arkansas is home to 14 million acres of farmland and Berryville, located in the Ozark Mountains, is a great place to enjoy the qu...

Digital Services

Digital Banking: Not Just for the Big Banks

Many of us rely on digital banking services to make our lives easier, from saving trips to the bank and helping us track our spending, to letting us pay our bi...

Checking

What is an FDIC Insured Bank Account?

With several bank failures in the news, many customers are wondering if their money at their bank is safe. You may have heard of FDIC insurance, but the terms...

Community

%20(33).jpg)

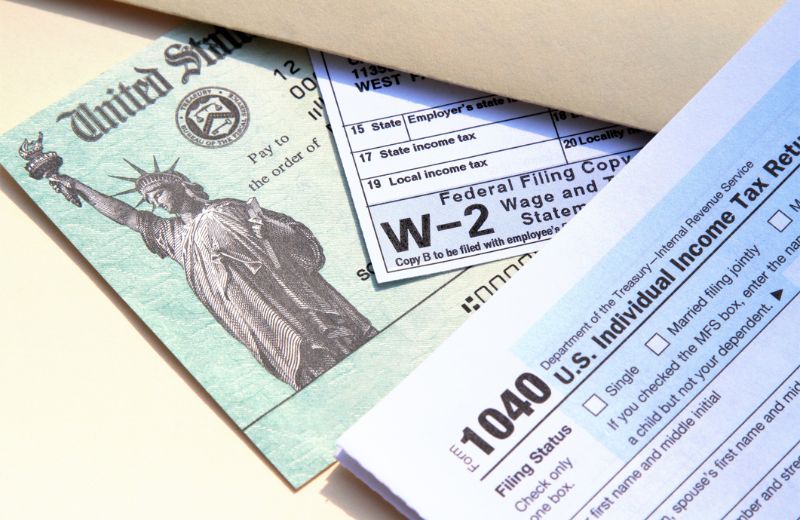

Tips for Preparing For Your Taxes

Benjamin Franklin famously quipped that the only certainties in life are death and taxes. And it’s probably a certainty that no one enjoys doing their taxes. H...

Business

Create a Cyber Security Training Plan for Your Small Business

As a business owner, small business cybersecurity is top of mind for you, possibly even keeping you up at night with fears about a data breach. Every time y...

Uncategorized

%20(21).jpg)

Checking Vs. Savings: Do you Need to Both?

Checking and savings accounts are both kinds of deposit accounts—accounts where you deposit (and withdraw) money. They’re designed to hold your funds securely...

Business

%20(49).jpg)

Is Now the Right Time to Start a Business

New business applications surged in 2020, a 24 percent increase from 2019. Although the COVID-19 pandemic has caused shutdowns and other economic disruptions,...

Mortgage

Smart House Hunting Tips in Northwest Arkansas

The journey of buying a house is undeniably exciting, filled with the promise of new beginnings and the anticipation of finding your perfect home. Whether you...

Agriculture

%20(24).jpg)

9 Money Savings Tips For Your Madison County Farm

Whether you’re starting a farm here in Arkansas or have been running a successful ag business for years, the rising costs of agriculture, coupled with recent ...

Mortgage

Renovate or Move? Making the Right Choice for Your Future

That familiar itch to upgrade your living space is something many homeowners experience. Whether it's a growing family, evolving style, or simply the desire f...

Mortgage

Can You Get a Mortgage with Student Loans?

While a student loan can affect your ability to obtain a mortgage, it’s possible to have a student loan and a mortgage simultaneously. Mortgage lenders will co...

Checking

5 Ways to Spring Clean Your Bank Account

Spring is in the air! As we embrace this season of renewal, many of us make time for the tradition of spring cleaning, eagerly sweeping away the grime and dirt...

Savings

11 Ways to Teach Your Kids Good Money Habits

It’s no secret that having a solid financial education can set up your child for a successful and secure future. Research has shown that financial literacy for...

Business

%20(45).jpg)

Finding Business Banking Efficiencies with Cash Management

Running a small business can be challenging, but luckily there are tools that can help. In this article, we’ll focus on Cash Management services, which help y...

Agriculture

%20(22).jpg)

How to Finance the Expansion of Your Family Farm

In Missouri and Arkansas, agriculture is our biggest industry, and the vast majority of our farms are family—owned—90% and 97% of farms are owned and operated ...

Agriculture

%20(52).jpg)

Farm Management Tips to Run Your Ag Business More Efficiently

With nearly 50,000 family-owned farms in Arkansas and 90,000 in Missouri, most local farms are run as a family affair. Unfortunately, smaller farms tend to ha...

Business

%20(20).jpg)

Tips for Getting Your Small Business Ready for the Holidays

Arkansas and Missouri are home to hundreds of thousands of small businesses—about 500,000 and 250,000 apiece to be precise. And now is the time of year for sma...

Uncategorized

Staycation Fun in Northwest Arkansas & Southwest Missouri: 9 Easy Escapes Close to Home

You don’t have to leave our region to make summer unforgettable. For folks across Northwest Arkansas and Southwest Missouri, a staycation is a perfect chance t...