With the average American having around $58,604 of debt and nearly 80% of households nationally having some form of debt, tackling your own may feel like an overwhelming challenge.

But instead of ignoring it and resigning yourself to the seeming normality of having debt, it’s important to understand how these can impact your financial goals.

Whether you’re looking to dig yourself out of a large, longstanding debt hole or you simply need to recoup some finances after overspending during the holidays, we’re here to help you lower your debt this year.

Good Debt vs Bad Debt

Before you start thinking about how you can pay down debt in 2024, remember that not all debt is bad! If it’s managed responsibly, some debts can be helpful in maintaining a higher credit score and demonstrating your credit worthiness when taking out new loans.

Debts like your mortgage or student loans can lower your overall taxable income for the year, with many of the interest payments you’ve made throughout 2023 being tax deductible. With mortgages, it’s also good to remember that by the time your home loan is paid off, your property should be worth more and you’ll benefit from the profits.

Bad debts, on the other hand, are usually those with high interest like credit cards, payday or personal loans. These types of debts often put you in a worse financial situation and can damage your credit if not paid off quickly. When prioritizing your debts, think about how to get out of credit card debt rather than channeling additional funds into a mortgage or student loan payoff.

Why Lower Your Bad Debt

Having a large amount of bad debt can significantly impact your future financial life. Your credit score can be negatively impacted, which can prevent you from taking out loans like a mortgage or car loan.

The interest you pay on many of these bad debts can also become costly very quickly. Instead, the focus should be on paying off these debts and using the money you save from no longer paying the interest in other ways, like funding your retirement or savings accounts.

It’s also likely that you feel stressed or anxious if you have a large amount of bad debt. Surveys suggest that over 70% of Americans feel financially stressed, so focusing on how to pay off credit card debt or reducing your personal loan balance can have a positive impact on your health.

How To Start Paying Off Your Debt

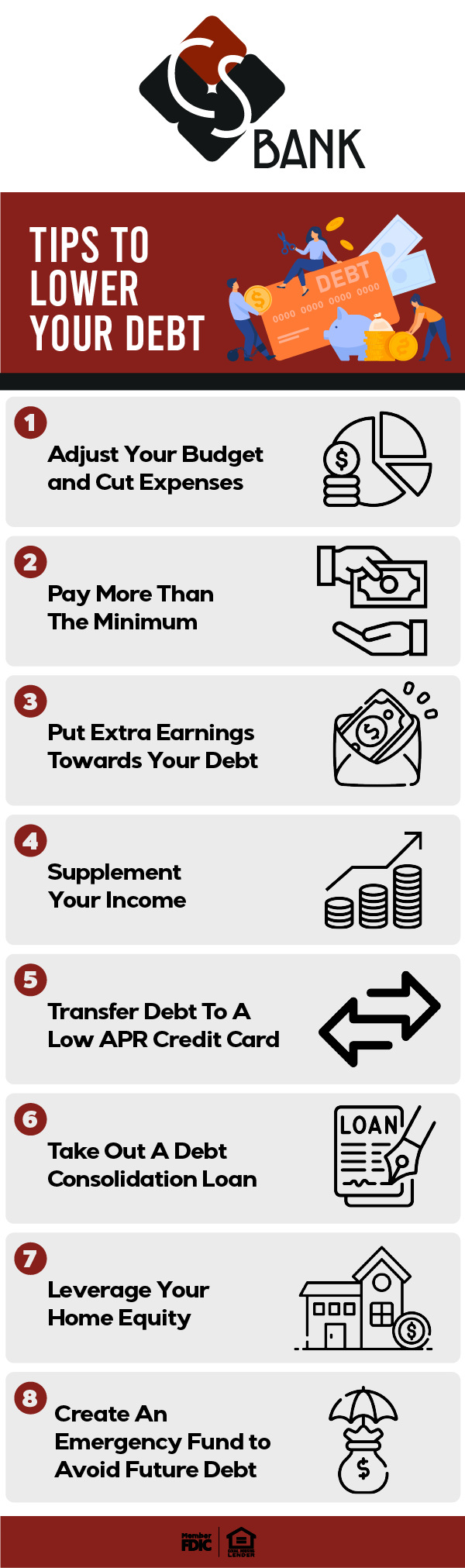

Adjust Your Budget

The best place to start with paying off debt is to look at your budget and find areas where you could cut back on luxuries. Avoid dipping into your existing savings too much, as you’ll still want to keep these for emergencies.

But you can probably find several areas of discretionary spending that you can cut completely or at least scale back on, with those savings going towards debt repayment.

If you don’t have a budget already, now is the time to create one. Budgets help you get a better understanding for where you’re spending, or overspending, and how you can better prioritize where your money goes each month.

Cut Expenses

When you go through your budget, look for areas that you didn’t even realize you were spending money on and cut those expenses entirely. It’s easy to forget about subscription services or food delivery costs, but they can quickly add up.

You could also look at temporarily cutting some expenses like eating out or bringing your lunch to work until you’ve paid off some of your larger debts.

Pay More Than The Minimum

As you adjust your budget to be more debt-repayment focused, aim to put more of your money towards your debts than the minimum payments required each month.

Debt accrues interest and it’s compounded, so the large your debt is, the more interest you’ll pay. The more debt you can pay off now, the less interest you’ll be paying over time.

Put Extra Earnings Towards Your Debt

When you find yourself with some additional cash, put that towards your debt. Tax refunds, bonuses at work, income from a second job or selling some of your unwanted belongings can all be great sources of extra earnings that you can use to pay off some debts.

Supplement Your Income

The gig economy is full of side hustle opportunities if you have time in your schedule to pick up some extra work. Consider looking at flexible part time jobs that you could do around your regular job, like being a food delivery driver, babysitting, or freelancing with the professional skills you have.

You can also go through your home and find electronics or other items that you no longer want or need that you can sell online for some extra cash.

Transfer Your Debt to a Low APR Credit Card

While you don’t want to take on additional credit card debt, you look at a debt consolidation technique of transferring your high balance debts to a lower interest credit card.

Many credit cards now offer low introductory rates, which you can benefit from if you pay off a large amount of your debt before the rate period ends. Just be sure to stay aware of when the rate ends and what the rate increases to when it does, so you can take care of your debts before the interest rate goes up.

If you don’t qualify for a debt consolidation loan, this can be an excellent alternative to lowering your debt this year.

Take Out a Debt Consolidation Loan

You might be wondering “is debt consolidation a good idea?” In most cases, it is. And there are plenty of ways that you can do this, including taking out a personal loan for debt consolidation purposes.

This type of loan lets you pay off all your debts in their individual places and concentrate that balance in one place, so you only have one loan to pay off. This approach is best for any non credit card bad debts you may have, like high interest personal loans. But you can also use this for credit card debt if you’re not able to pay off the balance during the introductory low interest period.

Leverage Your Home Equity

If you’re a homeowner, you may be able to leverage your home equity to pay off some of your debts. A home equity line of credit or home equity loan can be one of the best debt consolidation plans, giving you access to cash immediately at a lower interest rate than many personal loans or credit cards.

Refinancing your mortgage as a cash out refinance, where you take out additional money than what you owe on your home and use these funds for debt repayment, is another option. As mortgages are paid over a long period of time, their interest rates are usually more affordable. Adding to your mortgage to pay off existing debts can be a negligible increase on your monthly mortgage payment.

Create an Emergency Fund

Putting aside additional money into a savings account can seem counterproductive when you’re trying to pay off debt, but this is one of the best ways to avoid adding more to your debt balance. Start an emergency fund with any leftover money you have each month and don’t touch this cash unless it’s a true emergency.

Choose Your Debt Consolidation Method

If you have multiple sources of debt, create a plan for how to lower your debt as quickly as possible. There are two common methods that many people like to use:

- Avalanche method. This is where you pay off debts with the highest interest rate first and move through the list until all of your debts are paid off, from highest interest to lowest.

- Snowball method. Like the avalanche method, this approach focuses on starting with your highest cost debts. But instead of looking at interest rates, this method starts with your highest balance and works down to the lowest.

Get Help With Your Debt

If you need support in dealing with your debt this year, the team at CS Bank is here to help you take control of your finances as soon as possible. Along with Credit Counseling of Arkansas and Missouri Debt Solutions, our team can provide recommendations for agencies and services that can help you address large amounts of debt.