not featured

2025-06-06

6/6/2025

Mortgage

published

%20(35).jpg)

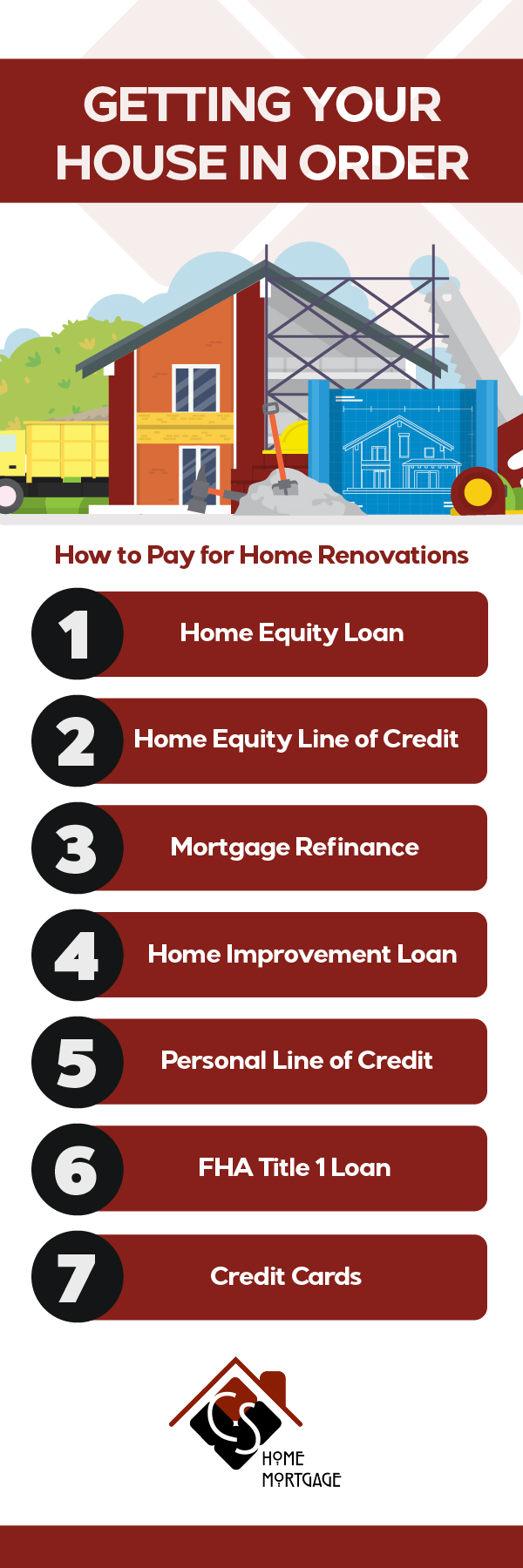

Getting Your House In Order: How To Pay For Renovations

Whether you’re hoping to stay in your current home for a few more years or you’re getting ready to put it on the market, working on renovations is a great way to add value to your property. There are plenty of options available for homeowners when it comes to paying for these upgrades, all without having to dip into your savings.

If you’re thinking about how to pay for home renovations of your own, take a look at some of our recommendations.

Home Equity Loan for Renovations

A home equity loan works in a similar way to a traditional mortgage. Except instead of financing the purchase of your home, you’re using the equity that you’ve already built up to finance your renovations. Equity is determined based on the amount left on your current mortgage versus your home’s current market price.

With a home equity loan, you’re often able to take out up to 80% of your property’s current value. And since these types of loans are taken out with a fixed sum of money in mind, the amount you’re repaying each month is clearly noted when you take it out.

They can come with either fixed or variable interest, along with application and mortgage costs, just like a mortgage. Be sure to choose the option that works best for you.

Home Equity Line of Credit

If you’re still unsure about the amount of money that you need for your project, a home equity line of credit (HELOC) may be a better option for you. Think of this like a credit card, but with no physical card in your hand.

You’ll still be borrowing against the equity that you have in your home, like a home equity loan. But instead of a fixed amount, you’ll be given a maximum credit amount that you can borrow up to. You’ll only pay interest on the amount that you use and any funds that are paid back before the end of the loan term can be reused.

A HELOC for home renovations is fairly common, especially as costs can increase as you’re going through construction. You can borrow as much or as little as necessary throughout the lifetime of the loan. And if you want to do another project after you’ve paid back what you borrowed, you can do that with the same loan.

Like a home equity loan, HELOCs come with both fixed or variable rates and there may be fees associated with opening or closing your loan.

Read more about the differences between a home equity loan and a home equity line of credit.

Home Loan Refinance

Another option for funding your renovations is to take out a new mortgage on your home through refinancing. This is where you replace your existing mortgage with a new one, for any amount that you can be approved for.

When you’re considering how to refinance a home loan for renovations, it’s important to consider the overall costs. Since this is a new mortgage, the standard application and closing fees associated with a home loan would apply.

There are several ways that you can refinance your property. Switching to a different loan type or one with lower interest rates can save you money long-term. Those savings on your monthly payments puts more money back in your pocket to be able to pay for your upgrades.

You can also do a cash-out refinance, where you’ll pay off the balance on your current mortgage with a new, higher loan and any of the leftover funds can be used for your renovations.

Refinancing can be a great option if you plan to stay in your home for long enough to recoup the application and closing cost fees of the new loan. It’s also a chance to take advantage of favorable market conditions if interest rates go down and you get approved for a fixed-rate mortgage with a lower interest rate.

Personal Home Improvement Loan

If you’d prefer to keep your mortgage and renovation funds separate, a personal home improvement loan is a good choice. These loans typically range from $1,000 to $10,000, so work better for smaller projects around your home.

Like other kinds of personal loan, these are unsecured. That means no collateral is required so approval times are generally much quicker, but you’ll be paying higher interest rates than a traditional mortgage.

One positive to keep in mind is that, unlike a home equity or HELOC, you won’t need to prove a certain amount of equity in your property to take out a personal loan. If you have good credit, you should have no problem taking out the amount that you’re looking for.

Personal Line of Credit

A personal line of credit, in a similar way to a HELOC, is an open-ended loan that gives you access to funds up to a certain amount for a fixed period of time. Interest is only paid on the funds that you borrow, and once those are paid back, you’re able to reuse them.

How you choose to use your personal line of credit is up to you and there aren’t any collateral requirements for this either. But it’s vital that you keep on top of your minimum monthly repayments once you start to borrow any money from your line of credit.

One of the best reasons to use this type of loan is if you aren’t approved for a HELOC. If you’ve already paid off your mortgage, you may not qualify for equity-based loans, so a personal line of credit can be a good alternative.

If you’re choosing to work on your renovations in small increments, a line of credit is often your best choice. Since you’ll only be repaying the amount you use and the interest on this, you’re able to take as much as you need, when you need it.

But it’s worth remembering that these loans don’t provide the same tax benefits that mortgages do and you may be faced with monthly maintenance fees, even if you’re not using the funds.

FHA Title 1 Loan*

An FHA Title 1 loan* is government-backed financing that’s offered through your bank. These funds are meant for any improvements to a home that makes it more livable or energy-efficient, and must be a permanent change to the property.

These loans are capped at $25,000 for single-family homes and come with extensive checks on your outstanding debts and payment history.

Credit Cards and Other Options

If you’re able to use a 0% APR credit card to finance your renovations, this can be a good option. This is especially the case if you’re doing your renovations yourself and only need funding for the construction materials. Many contractors won’t accept credit cards, so you’ll still need access to cash to pay for the labor costs.

There is also the option for you to borrow money from your own 401(k) account. The IRS allows withdrawals for home improvements of amounts under 50% of your home’s value, capped at $50,000. There will be income taxes due on this money, along with a 10% withdrawal penalty if you’re under 59 ½.

Spruce Up Your Property With A Renovation Loan

When you’re ready to get started on your home renovation project, contact the team at CS Home Mortgage. Our full-service mortgage lenders will work with you to find the best home improvement solutions for you, whether that’s applying for a new mortgage or taking out a home equity loan. Contact us today or stop by one of our convenient locations in Northwest Arkansas or Cassville Missouri.

*CS Bank/CS Home Mortgage does not offer FHA Title 1 Loans